Give the experience customers need and expect

Eliminate the guesswork with trusted insights. No questions unanswered.

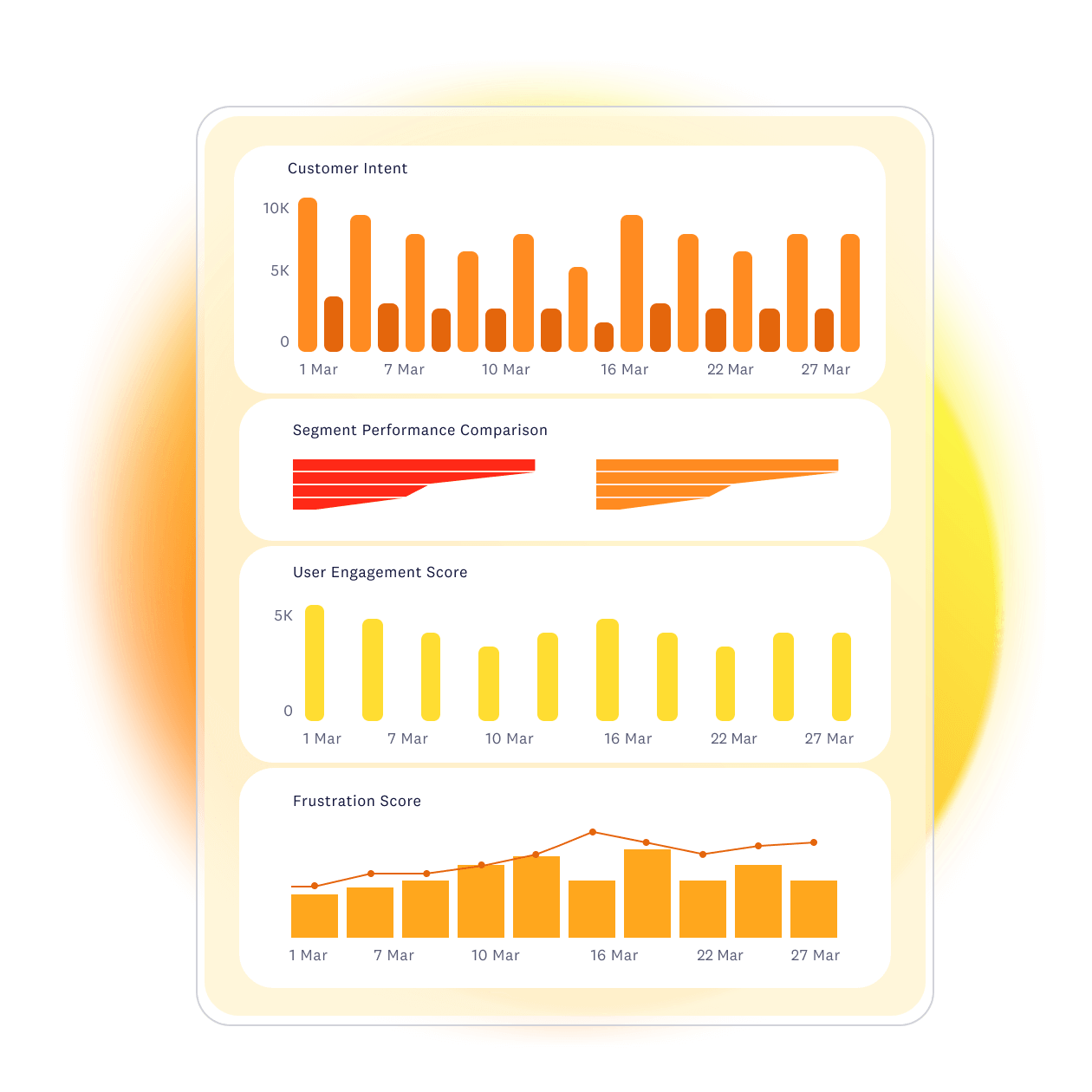

Understand each website visitor’s intent as they move in-and-out of your digital journey so you can proactively take prioritized actions and win back customers before the session is over.

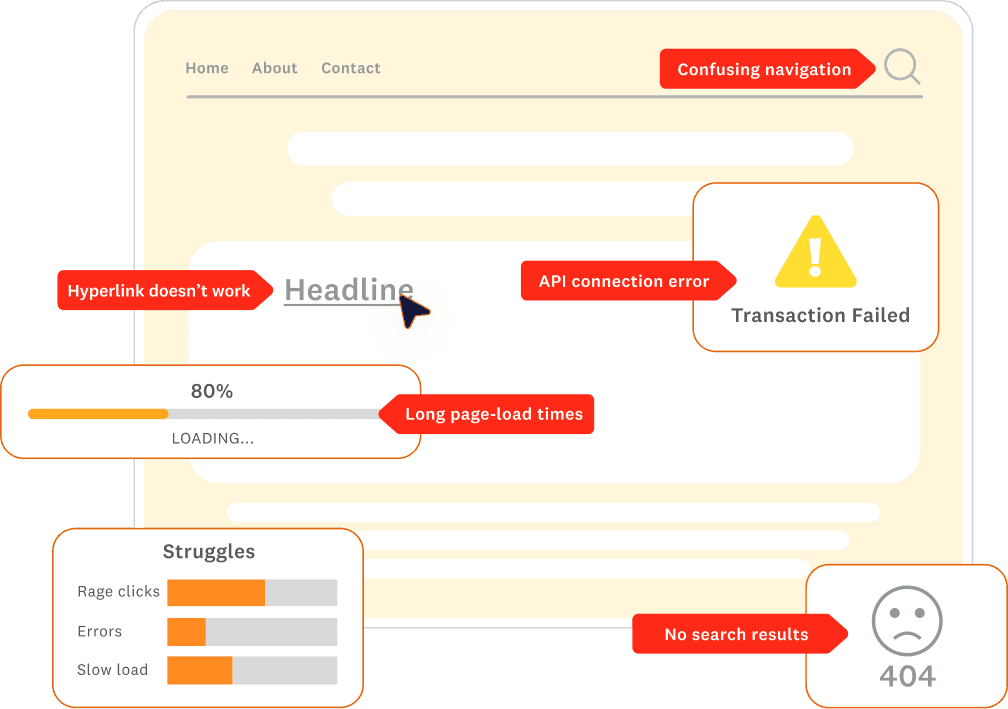

Visually understand user behavior, content interactions, and struggles on any page and find opportunities to increase adoption, conversion, and retention.

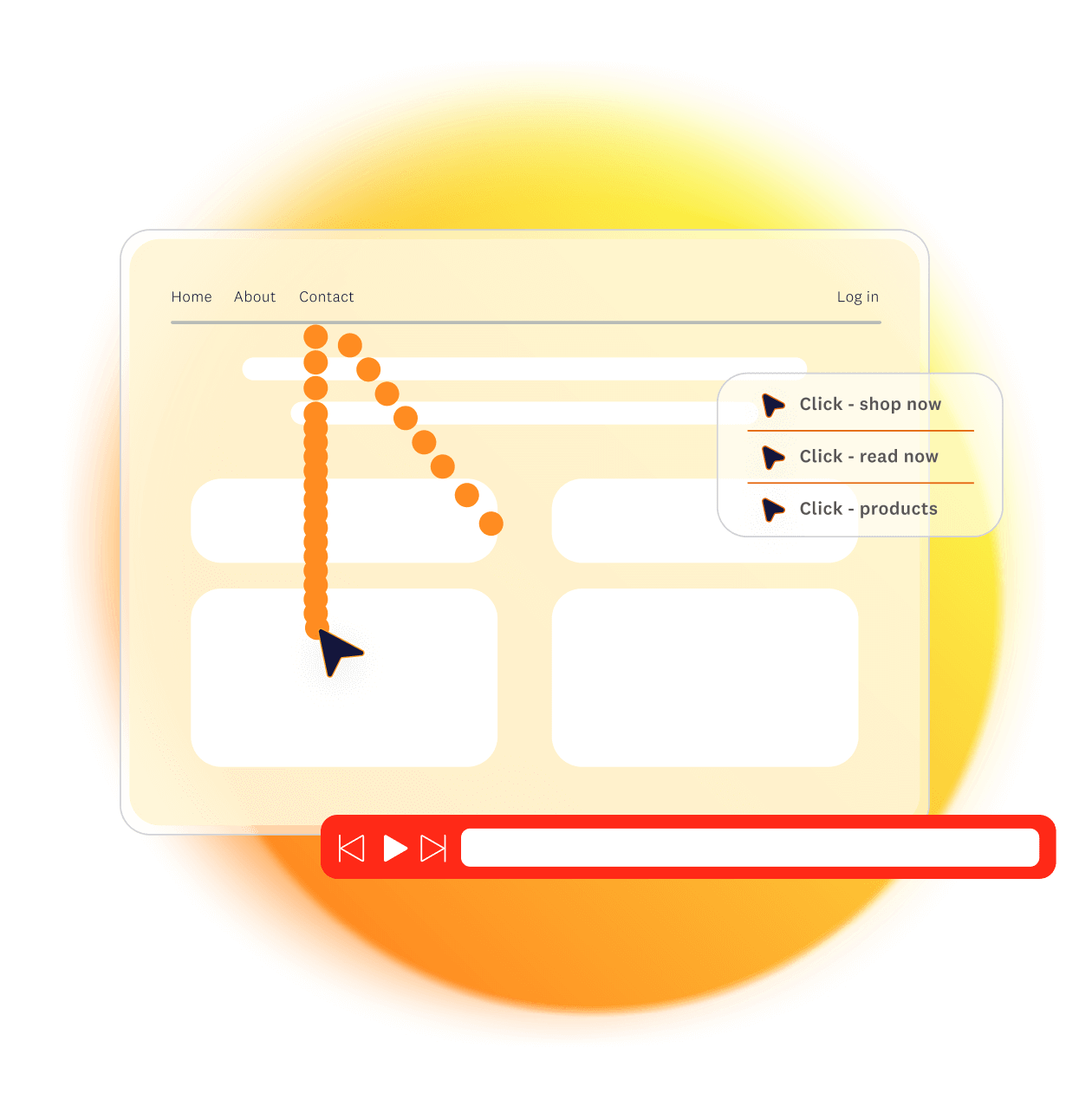

See each visitor’s experience from their point of view and gain real time insight into why they behave the way they do across your digital journey and experiences.

Effortlessly and confidently close the gaps across your digital customers' journey and experience.

Understand which customer experiences boost revenue and outcomes, pinpoint inefficiencies, and strategically direct increased investments for optimal results.

AI-driven customer analytics reveal revenue-boosting opportunities and pinpoint conversion losses automatically.

Use AI-powered customer analytics to gain the insights needed to enhance engagement, conversion, and loyalty.

Capture visitor behavior, understand their motives and intent, and use this insight to guide them through their digital journey to conversion.

Reduce time and resources spent on trying to make sense of your data. Tealeaf automatically surfaces what is truly working and not working and why, so you can quickly understand your biggest opportunities and issues.

Not all experiences are alike. Pinpoint issues and see in real-time how customers behave at any point in the digital journey to further qualify your behavior data.

Quickly prioritize your most urgent UX issues by quantifying customer frustration, user struggles, and system anomalies and fix them before your customers leave your digital experience.

See how users engage with your products from hovers to clicks, track behavior trends across the digital journey, and understand how the front-end behaves for every single user to deliver and optimize a personalized experience.

Many times, we tend to react to the loudest customers, and here, now, we have the data.

Just a few examples of how different teams across the brand can investigate, build, and optimize the digital journey with more ease and confidence.

Understand why some forms or campaigns outperform others.

Test what matters to the user, and quickly validate your work.

Recreate all experience in real-time to align around a single source of truth.